Our Farmland Investment Strategy

A brand new way to invest in real estate.

The Farmland Investment Opportunity *

Seldom will you find an investment opportunity where you can hedge inflation, mitigate downside risk during a recession, and end up with a zero-risk, passive investment that keeps delivering returns to you while building your wealth over the long term.

And sometimes those opportunities come from the most obvious, yet unlikely places.

In this detailed overview of Bravante Farm Capital's investment strategy, you will learn how you can receive outsized, risk mitigated investment returns from investing in farmland that produces someone everyone needs and wants, food.

Please click a contents item below to jump to the relevant section:

- Why farmland investing is different

- 10 Key Benefits of Investing with Bravante Farm Capital

- Why this is a Truly Rare Opportunity

- 6 Pillars to Our Success

- Water and Drought: Here's Why Demand and Values Will Increase for Our Ranches

- Investment Summary

- The Opportunity for Investors

- Inflation, Recession, and Real Estate Downturn Resilient

- Investor Friendly Deal Structure

- Alignment of Interest

- How a $100,000 Investment is Projected to Look

- Space is limited

- Here's what to do next.

- The 'Cliff's Notes' version.

Why it's different

Investing with Bravante Farm Capital (BFC) is different from other real estate investing for two reasons:

One, the economic structure of our deals is engineered to withstand inflation, rising interest rates and recession, and two, four macroeconomic advantages that make this opportunity stand out among all other types of commercial real estate investments.

1. The Bravante Farm Capital Deal Structure

Here's what you get when you invest with Bravante.

First, you receive an 8% preferred return. That is a yield on your investment every year.

Then, before the general partner at BFC receives any share in the profits, you will get back all your invested money.

Once 100% of your money is returned to you, i.e. no further risk to you, the general partner receives what is called a ‘catch up.’ This is where distributions go to the sponsor until he and the investors together have received a 70/30 split of distributions (not including return of principal) in favor of the investors.

Then even though you have no money left in the deal, investors share in 70% of all profits until their original investment amount is doubled.

And then, once you have doubled your original investment, you will still receive your pro-rata share annually of 50% of all the profits, either from sales of produce or sale of the farm itself.

This is what is called The Holy Grail of real estate investing; continued income and wealth building, but with no money left in the deal.

2. Four Macroeconomic Advantages

The second reason this opportunity is different is because there are four macroeconomic factors that offer unique advantages over other real estate investment opportunities:

Macroeconomic Advantage Number One. We are likely headed into a recession and economic turbulence, and our strategy is specifically engineered to protect your investment as much as possible, to ride any economic storm and still deliver income on your investment while building your wealth.

Here is how it is done.

First, this is a ten-year plus business plan.

Two, we are taking on very low debt, no more than 50% of the total project cost.

Three, you will get your original investment back as a priority and then continue to earn income. The general partner does not receive any share of the profit until you get your money back with interest.

And four, BFC has very low general partner fees compared to other commercial real estate deals.

Macroeconomic Advantage Number Two. This opportunity is different in part because the drought in California is causing a lot of farmland to go fallow, causing supply to shrink, even though demand will continue to grow.

Our focus is on what we call The Oasis, which is a small region in the Central Valley of California with long term, abundant and sustainable water supplies. The sustainability of The Oasis is going to lead to a disproportionate increase in the property values there as opposed to other areas in the Central Valley. This is where we are buying and where we are investing.

Macroeconomic Advantage Number Three. Institutional investors increasingly are buying up farmland, which is driving up values and consequently driving up returns to our investors.

Macroeconomic Advantage Number Four. This is different from real estate offerings you have seen before because, unlike multifamily properties, most investors know very little about farming.

This means that the competition is low, the market is inefficient, and consequently values are low compared to better known multifamily investments which everybody understands and clamors to invest in.

By getting in early, you can benefit from this lack of competition and consequent imbalance between what the real estate sells for today and its true long-term value.

Space is limited and we expect each acquisition to oversubscribe quickly.

10 Key Benefits of Investing with Bravante Farm Capital

There are 10 key advantages to investing with Bravante Farm Capital that add value and builds wealth for you as an investor. You are invited to join us in this rare opportunity to directly own and operate farms.

1. Number one. Food is a great hedge against inflation because food prices are not driven by inflation, inflation is driven by many factors including the cost of food.

This means that the value of your investment rises with inflation.

2. The second key advantage is that farmland revenues thrive during recessions. People stay home, save money, and eat more.

3. Food is a product that everyone needs. Sure, everyone needs somewhere to live, but everyone needs to eat even more than they need housing.

4. We use only low leverage, no more than 50%. This is critical. Debt can be a killer in real estate investing. With our investments we will take on no more than 50% debt.

5. We bring economies of scale to our farm operations that drive down costs and increase investor returns.

6. BFC employs institutional investment standards to our deals. Everyone on our team has an institutional commercial real estate background.

7. We maintain a strict policy of sustainable yet profitable farming.

You can feel good that what you're doing good about 'how' our farms are being managed.

8. We leverage the upside of the drought. This is the glass half-full approach. Your investment will go up as the demand for our ranches increases in value.

9. Increasing institutional investor interest in farmland is disproportionately driving up values and increasing returns to investors.

10. The 10th key advantage to investing with BFC is that we are consolidating a highly fragmented industry into large scale ranches that will be attractive to institutional investors down the road.

Truly Rare Opportunity

Our farm acquisitions are truly rare opportunities with limited space for investors.

We have set the minimum investment at $25,000 to make it easy for you to begin investing with us.

However, because of the nature of the farms we target for acquisition relatively small our offering can accommodate a maximum of around 150 investors.

If the average investment hits $100,000, which is not uncommon with this kind of investment, that would mean fewer than 40 or so people may actually be able to participate in each deal.

If you are interested in learning about specific deals, you should act quickly. Please apply to join the waitlist for our next farm acquisition here.

6 Pillars to Our Success

There are 6 pillars to our success at BFC and in this section we will cover them in detail. They are as follows:

1. The historical disconnect between farmland pricing and its true value as income producing real estate.

2. The consolidation of a highly fragmented industry that makes it attractive to institutional buyers.

3. An application of classic commercial real estate value add strategies.

4. The BFC packing and shipping competitive advantage.

5. Outsized tax benefits that are unique to farmland.

6. Capitalizing on the upside of a reduction in farmland supply due to drought.

Pillar #1: True Values are Higher Than We Pay

Even though we may pay a slight premium for the farms we buy, there remains a disconnect between what we are paying and its true value as income producing real estate. Normally, income producing property is valued based on the income it can produce. However, farmland has historically been sold by the acre based on comparable sales and its income producing capability has not been taken into account.

This can be a hard concept to understand as it makes no intuitive sense that owners and lenders would not value an income producing asset on the basis of the income it produces.

But it is the way farmers have always traded and sold – on a how-much-per-acre basis.

This incongruous methodology has been reinforced by banking regulations that prohibit banks from using the income approach when making loans to farmers. Essentially, it does not matter how many orange trees you grow on an acre, one or one hundred. Loans can be made only on the basis of comparable land sales.

In the multifamily apartment complex world, it is a bit like market prices being based on price per unit and not on the net operating income that those units generate, i.e. value based on the number of apartments in a building and not on the rent those apartments generate.

It makes no sense at all. But it is the way that it has always been done. The consequence is that it has created an inefficient market for farmland real estate versus that which exists, for example, for multifamily or just about any other kind of income producing real estate.

And it is where, in part, we are finding opportunities for disproportionate investor returns.

While the reason for this discrepancy is uncertain, it is possible that it stems from the perception that farmland income is too unpredictable. Even if this is the case, however, BFC focuses only on crops that have long term, predictable income with relatively high margins. Consequently, high yielding farms like those that we own, operate, and are buying are lumped in with low yielding farms sold on a per acre basis and sold for less than their true value.

Herein lies part of our opportunity - the disconnect between the way that farmland is valued and the potential it has for generating income for investors.

But this is changing.

Institutions are now entering the farmland real estate market and they do underwrite to yield using cap rates as their guide.

To put this into perspective, the exit cap we are predicting for one of the first deals we're working on is over 16%.

This is incredible!

Think about the multifamily deals you see.

A 16% cap rate is the equivalent of a six times multiple in stock dividend terms.

And that is our projected exit cap!

Furthermore, as institutions increasingly enter the market, they drive up land values because they bring the income approach to farmland underwriting to yield.

BFC leverages this disconnect by buying farms by the acre, adding value, and watching their value increase as cap rates become increasingly used, start to compress, and the values of our farms go up, driving investor profits.

Pillar #2: Market Consolidation

We consolidate a highly fragmented industry to make it attractive to institutional buyers.

The farmland industry in California is highly fragmented. There are some 70,000 farms in the state, many in the 20–40-acre size range.

It's similar to the 20–40-unit apartment building purchase opportunity. Nice for mom and pop, but of no interest to private equity or institutional investors.

Many of the farms we target for acquisition have been owned by multiple generations of farmers, but the current generation is aging, in their seventies and older, and the next generation has little interest in farming.

By buying these smaller farms, adding value through redevelopment and improved operations, BFC is creating larger and more profitable farms that can be combined to a scale that attracts institutional buyers at significantly higher values, which in turn provides outsized returns for you, the investor.

Pillar #3 – Value Add Real Estate

The farms we acquire are often those that have provided an adequate living for their owners for generations but they also are currently inefficiently operated with low profit crops.

These farmers do not want to change the ways that they have always farmed.

They do not want to invest in their farms and they are happy with the income they receive. They also may be, and probably are, unaware and disinterested in the true potential that their farms have.

These are value add farms that we are targeting for acquisition.

Our process is similar to what a multifamily operator looks for in a 20- or 30-year vintage apartment building that needs upgrading to maximize revenues.

For example, multifamily value-add looks like this:

- Remove old, outdated kitchens and bathrooms and replace with granite countertops, new cabinets and flooring.

- Invest in upgraded HVAC systems.

- Introduce rubs (?) to utility billing system.

- Invest in renovating the exterior shells.

- Redo landscaping and repave parking areas.

Investing in farmland is not dramatically different. here are five ways we add value to our farms. We:

- Remove old, outdated and economically suboptimal crops and replace them with high profit, high demand crops with long life cycles and high sustainability.

- Invest in upgraded irrigation systems by adding drip line systems to complement flood irrigation systems.

- Employ irrigation deficit strategies where crops are starved of water during certain parts of their lifecycle to promote healthy fruit development.

- Invest in wind machines for crop frost protection.

- Employ enhanced farming techniques like pruning citrus trees to optimize crop size, color, sweetness and overall pricing, and tipping grapevines to promote optimal shape, texture, color and overall quality.

It is easy to be overwhelmed the first time you hear about advanced farming. But if you are familiar with multifamily value-add investing, you will find that in many respects, it is not much different.

And BFC is the foremost industry expert in California.

For example, multifamily value-add looks like this.

- Remove old, outdated kitchens and bathrooms and replace with granite countertops, new cabinets and flooring.

- Invest in upgraded HVAC systems.

- Introduce rubs to utility billing system.

- Invest in renovating the exterior shells.

- Redo landscaping and repave parking areas.

You know how it works in the value-add apartment world and now you know how it works in farming. It is just not that difficult to do yet very few people invest in value-add farms like this – and BFC is the foremost industry expert in California.

And there is one often overlooked advantage to investing in farmland over multifamily properties.

Our tenants do not complain.

They do not fail to pay rent, cause damage or end their leases.

Trees quietly grow with never a cross word spoken and produce income producing crops for our investors.

Pillar #4 – The Bravante Farm Capital Packing and Shipping Advantage

There are four phases in generating returns to investors from farming:

- Grow the crop.

- Harvest and transport it to a packing house.

- Pack it.

- Ship it to the store.

There are two primary types of packing house, those that are owned by farmers themselves (very rare) and independent packing houses that only pack and ship.

At BFC, we own and operate a state-of-the-art packing facility, and without exception, the farms that we target for acquisition rely entirely on third party, independent packing companies.

This means that we earn more profit at the ranch through economies of scale, by reducing the cost of harvesting, packing, shipping, and by simply being more efficient in that process.

For example, small farmers who are dependent on independent packers will face these kinds of issues.

- Crops have an optimal time for harvesting; but independent packers often do not show up on time so farmers can miss critical revenue generating windows.

- A packer may show up to harvest the crop, but their downstream buyers may have already bought as much of that produce as they want from the packer. So the farmer ends up with either nothing harvested, packed, and shipped, or just a partial crop taken care of.

- Independent packers in the Valley often have favorite customers and some small farms may not be on their list. It is the same with any industry where interpersonal relationships give priority to one grower over another.

- Costs are significantly higher when hiring an independent packer because those companies have to build their own overhead and profit into pricing.

Again, the similarities between farmland and commercial real estate investing are striking.

Consider our value-add multifamily operator. A smaller shop will be dependent on third party architectural, construction and property management companies. A bigger operation will bring these functions in-house to give them better control over timing, costs, and economies of scale.

If your crew is out there updating the units, you know they will show up on time, buy in bulk, and that in the end it will take less time and cost less.

The financial impact of this structure for BFC and for our investors is significant.

First, our costs are about 8% lower than independent packers. This adds about 4% in profits to the bottom line. And second, because we are vertically integrated, we get higher utilization of the fruit being harvested which means that we sell up to 7% more produce from the same crop as an independent packer shipper.

By owning and operating our own packing facilities, we keep costs down and can sell more fruit, leading to approximately an 11% advantage that drops straight to the bottom line, i.e. profit that comes straight back to investors.

Space is limited and we expect each acquisition to oversubscribe quickly.

Pillar #5: Special Tax Benefits Exclusive to Farming

There are four key tax benefits to farming and the first two are common to almost all commercial real estate. One, profits can be offset against expenses, thereby reducing taxes. And two, depreciation can reduce taxes on income.

The second two tax benefits, however, give farmland investors an advantage over commercial real estate investing.

Bonus depreciation is the first and is unique to farmland. It accelerates depreciation tax deductions more than any other commercial real estate asset class. And second, there are typically lower property tax rates on farmland versus commercial real estate.

Some of these benefits pass straight through to investors, and there are some deductions that investors can use to offset passive income they receive on other investments they may have.

Of course, all investors should check with their accountants on any of this and the impact on their net returns. Plus, it is not wise to base any investment decision solely on expected tax benefits. They are simply an extra advantage that farmland has over other types of commercial real estate.

Pillar #6: Leveraging the Upside of Supply Contraction Due to Drought.

California is in a drought.

Some areas will run dry and the land will become fallow (unfarmable), and other areas will continue to have abundant water.

Over time, those areas gradually losing water will become less expensive to buy and eventually will become worthless to farming.

But those areas with water will become increasingly expensive to buy as supply elsewhere in the valley shrinks and becomes increasingly high value farmland.

There are various strategies to capitalize on these changes. For example, some investors buy land that is destined to become fallow in the next ten years or so. They buy at a discount today and plan to underwrite returns until the land runs dry.

This is similar to a ground lease investment where there is a limited amount of time left on the lease and any improvements return to the leaseholder when the lease expires.

This strategy is an interesting investment play in the Valley but it is not for BFC.

We have our eye on the long term. We are building multi-generational wealth that just keeps on growing the longer we own the real estate.

We are focused exclusively on those areas in the Central Valley that will continue to have abundant water, where the prices are already at a slight premium, and where we are predicting prices will go up disproportionately.

Quite apart from a reduction in supply due to drought increasing values, or increasing interest from institutional investors having a similar effect, there are regulatory changes that are driving up the value of our ranches: SGMA

Imagine somewhere in LA where local code restrictions shut down large swaths of apartment buildings for some, irreversible reason. Demand, rents, and values for those buildings remaining would skyrocket.

That is exactly what is happening in the Central Valley as regulations called the Sustainable Groundwater Management Act, or SGMA, are literally shutting down access to water in large areas of the valley.

We are focused on investing in an area that has long term, abundant water supplies and is only about 500,000 acres in size. To put that into perspective, the entire Central Valley of California has about 11 million acres so our target area is less than 5% of the Central Valley (There are 101.5 million acres for the entire state of California).

This small water abundant area we have named The Oasis and this is where we see excellent investment opportunity.

Space is limited and we expect each acquisition to oversubscribe quickly.

Water and Drought: Here’s why demand and values will increase for our ranches in The Oasis

Our target acquisitions all lie within the area of the Central Valley of California known as The Oasis.

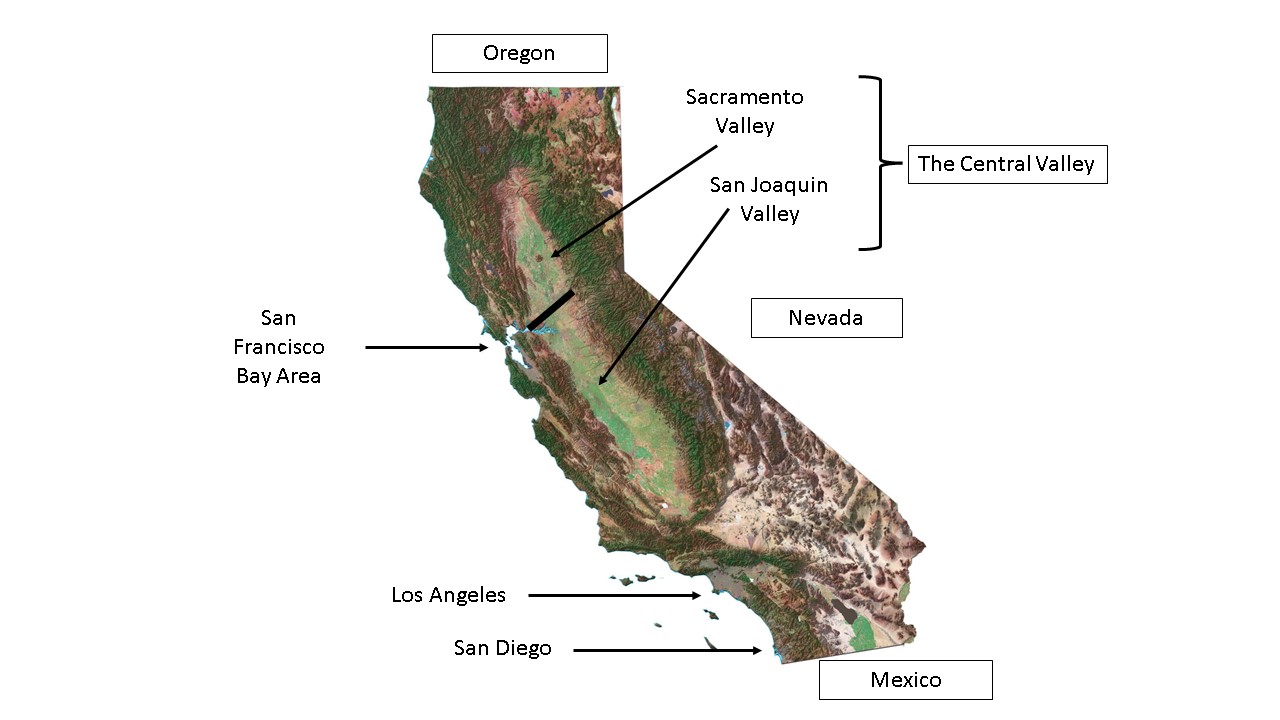

In the satellite map of California below you can see clearly the Central Valley - - the green area right through the middle of the state.

Source: https://gisgeography.com/wp-content/uploads/2013/02/California-Satellite-Map.jpg

You can see how the valley is situated relative to adjoining states and to Mexico, and that it is split into north and south valley, where the north is the Sacramento Valley and the south is the San Joaquin Valley.

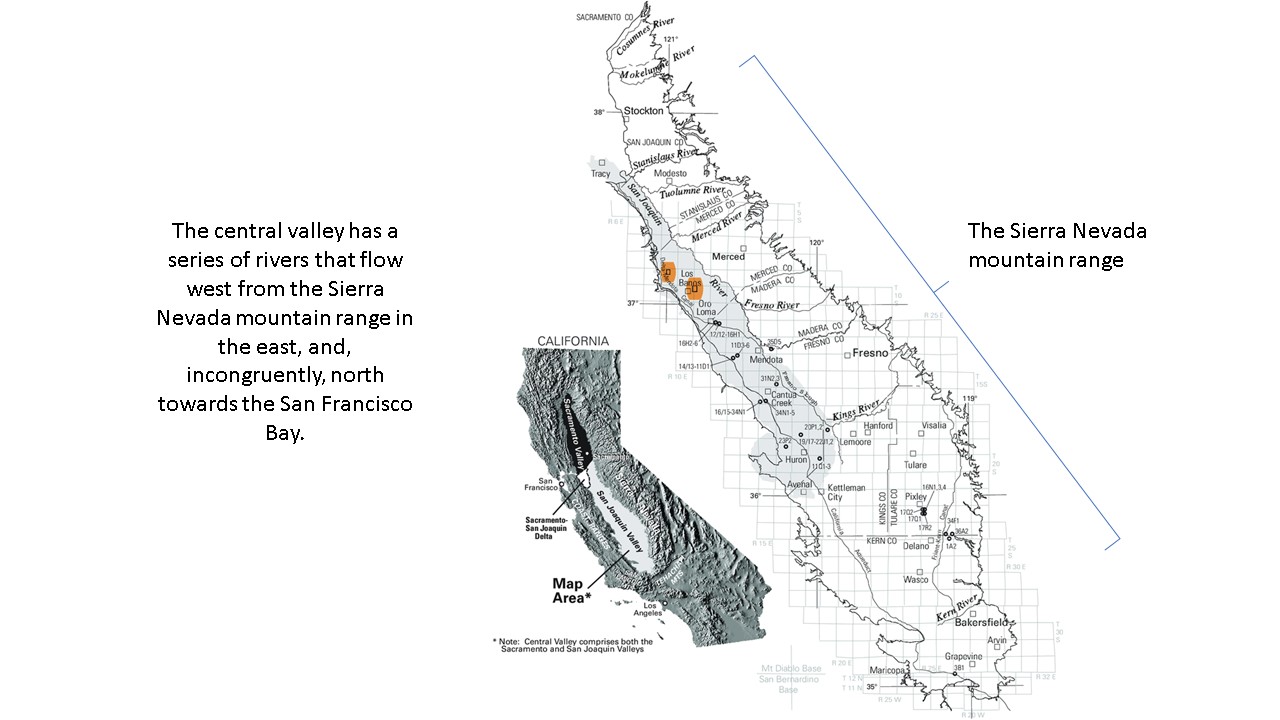

The next maps show how the Central Valley has a series of rivers that flow west from the Sierra Nevada mountain range in the east and, incongruously, north towards the San Francisco Bay.

Source: https://www.researchgate.net/figure/Location-of-selected-features-in-the-Central-Valley-California_fig1_237582797

On the right of the map above, you can see the Sierra Nevada Mountain range and a crisscrossing of rivers across the state. These rivers supply surface water across the valley via a series of dams, rivers, and canals shown in the map below.

The rivers and dams shown in the map above also serve to replenish groundwater, which is water held underground in large lake like aquifers, like water warehouses from which water can be pumped through wells.

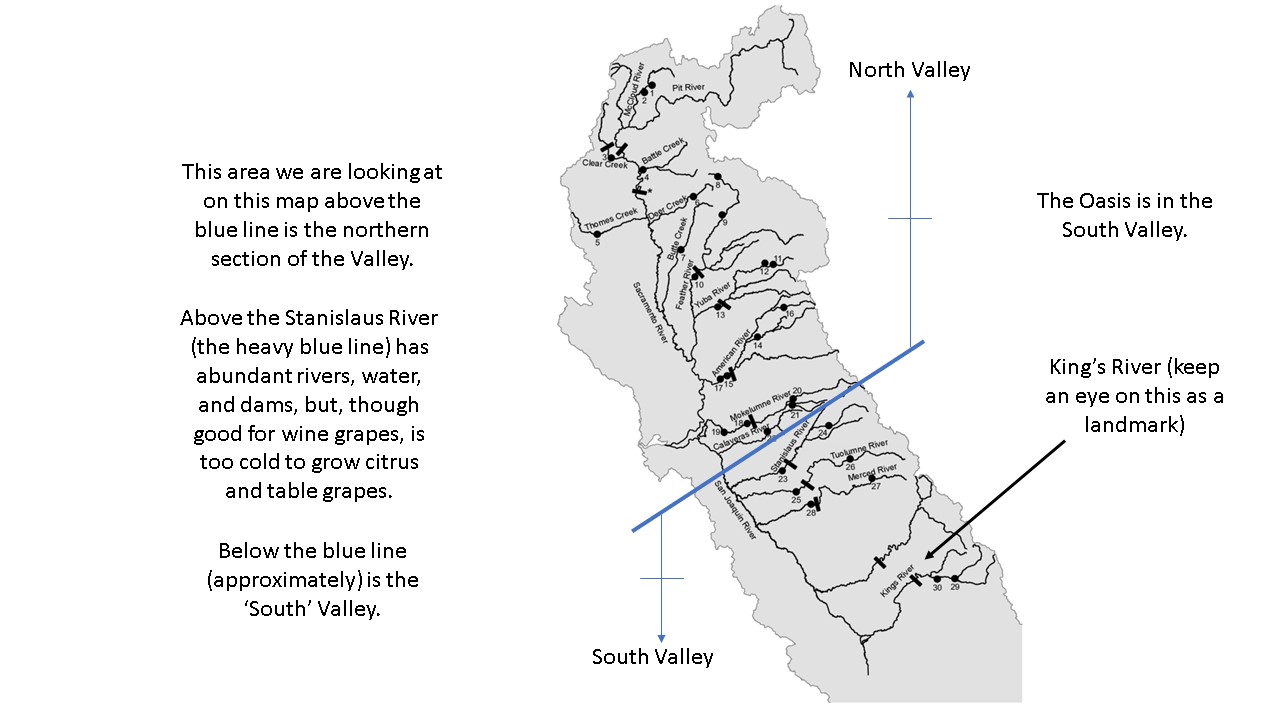

Above the blue line on the map is the north section of the valley, above the Stanislaus River. There are abundant rivers, water, and good dams in the north and although it is a good region for wine grapes, it is too cold to grow the high profit citrus and table grapes that we focus on.

Below the blue line, approximately, is the South Valley.

The Oasis is in the South Valley.

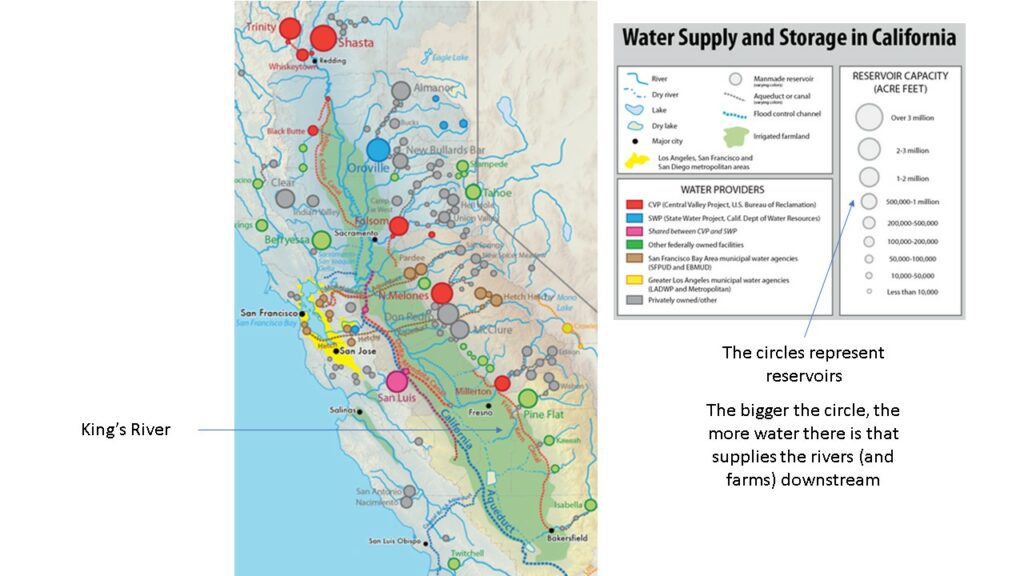

The next map, below, shows the water supply and storage system in California and the circles on this map represent reservoirs. The bigger the circle, the more water available to feed the rivers and the farms downstream.

Source: https://commons.wikimedia.org/wiki/File:Water_in_California_new.png

As you can see from the map above, there is a preponderance of reservoirs and other water storage illustrated by the circles in the North valley which indicate abundant water.

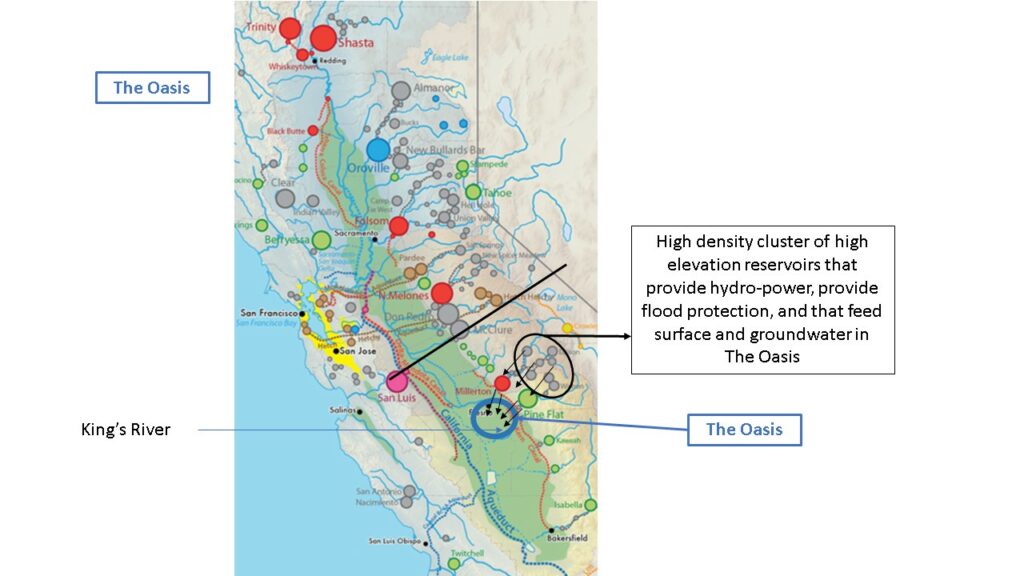

The Oasis is in the South Valley and is shown in the map below.

Source: https://commons.wikimedia.org/wiki/File:Water_in_California_new.png

In the map above, you can see a high-density cluster of high elevation reservoirs that in addition to providing hydropower and flood protection, feed surface and groundwater in The Oasis.

These high elevation, smaller dams and reservoirs serve two major dams here, the red and green, Millerton and Pineflat dams, and those in turn service The Oasis, indicated by the blue circle on the map.

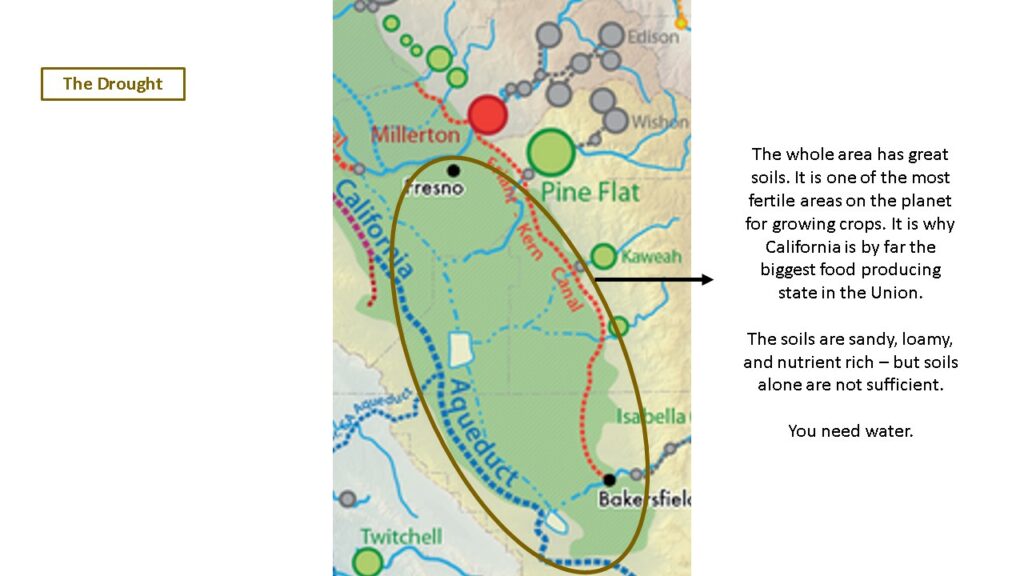

Now, let us take a look at the location of the drought and what that means. In the map below, you can see the South Valley with a large area indicated in brown. The whole area here in the South Valley has great soils and is one of the most fertile areas anywhere for growing crops.

In part, this is why California is by far the largest food producing state in the country. The soils are sandy, loamy, and nutrient rich. But soils alone are not sufficient – you must have water too.

Source: https://commons.wikimedia.org/wiki/File:Water_in_California_new.png

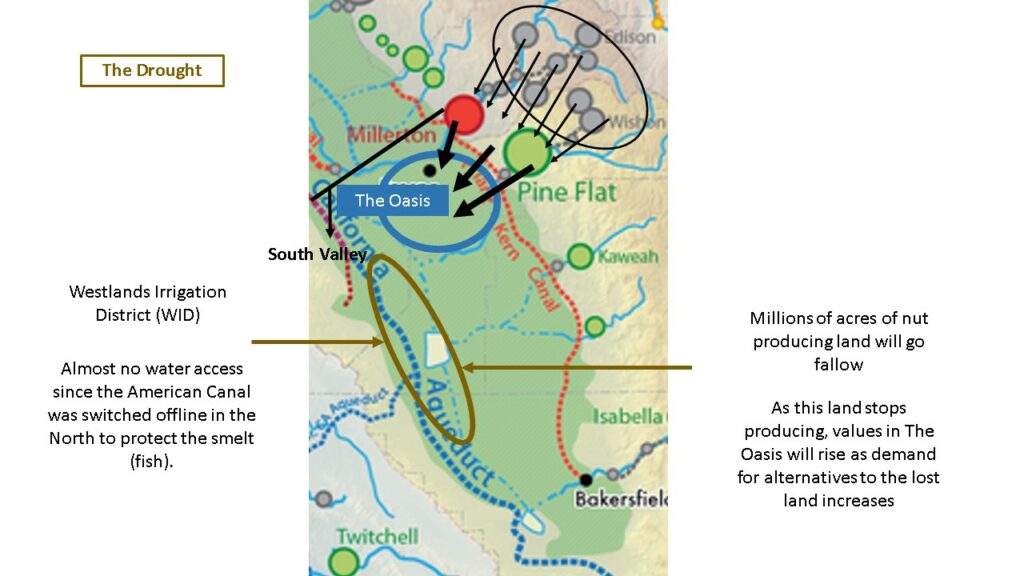

On the next map, below, you can see multiple, smaller supplies of water channeling into the two large dams that feed The Oasis. On the left-hand side, shown with a brown oval, is the Westlands Irrigation District.

This area has almost no water access since the American Canal in the north of the state was switched offline to protect the smelt (fish). Millions of acres of nut producing land in this area is going or will go fallow. And as this land stops producing, values in The Oasis will rise as demand for alternatives to replace the fallow land increase.

Source: https://commons.wikimedia.org/wiki/File:Water_in_California_new.png

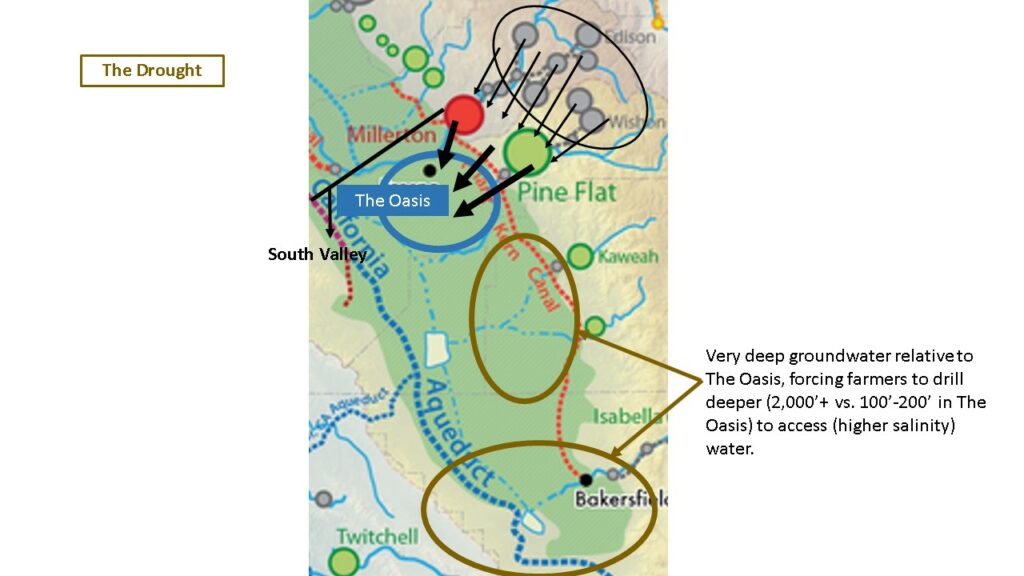

Two additional areas in the South Valley are significant, as shown on the next map, below. These two have very deep groundwater relative to The Oasis, forcing farmers to drill ever deeper. Farmers in this area must drill 2000+ feet verses 100 to 200 feet to access water in The Oasis. Water this deep typically has higher salinity and other contaminants. It is not good for farming as it requires additional expensive treatment once pumped.

Source: https://commons.wikimedia.org/wiki/File:Water_in_California_new.png

In these areas shown in brown on the map above, there is more farming of citrus and table grapes than anywhere else in the South Valley. These are our crops also, but the areas shown in brown are critically over drafted which means too much water has been pumped from wells over the years.

This has led to major subsidence issues where the land has collapsed. SGMA has mandated regulatory restrictions on future water use in these areas to protect infrastructure (roads, buildings) and preserve long term water supplies.

As the three main areas described above in the South Valley begin to lose access to water over the next few years and become increasingly fallow, the supply of good citrus and table grape producing areas will become smaller.

Demand for productive land in The Oasis will increase as a result and values will increase disproportionately.

Space is limited and we expect each acquisition to oversubscribe quickly.

Bravante Farm Capital Investment Summary

1. Bravante Farm Capital is focused on buying assets in The Oasis in the California Central Valley

2. We buy small, underutilized farms from legacy owners.

3. Our strategy is to add value to optimize revenue, sustainability, and profitability.

4. We bring economies of scale through packing and shipping in-house.

5. We consolidate farms into large institutional scale ranches to provide high value exit options.

6. We benefit from the disproportionate rise in our ranches’ values from the macroeconomic forces of increased institutionalization of the industry, changing pricing from a per acre to a yield based underwriting, and elimination of vast tracts of farmland due to water supply issues, while at the same time benefiting from increased population growth and hence demand.

7. We deliver outsized returns to our investors with a Holy Grail economic structure that eliminates risk while continuing to deliver dividends to you while building your wealth.

The Opportunity for Investors

These high potential, value-add farms are few and far between. Only two or three become available every year, usually when a farmer retires and heirs do not want to continue the family business.

To give you the best possible introduction to this real estate asset class we target only farms that have exceptionally high investment potential. The General Partner always invests at least 10% of his own capital as a co-invest to demonstrate our confidence by having ‘skin in the game.’

We will raise capital for each deal we find individually (no fund structure) and we invite you to join the waitlist now to become a gentleman or gentlewoman farmer with us and participate in these deals as a limited partner.

Inflation, recession, and real estate downturn resilient

We engineer our acquisitions to insulate them as best as we can from inflation, rising interest rates, and other economic fluctuations by:

* Minimizing debt to less than 50%.

* Building a long term, 10+ year plan. This is the optimal real estate life cycle to build multigenerational wealth that continues to provide income even after your invested capital has been returned.

* Structuring the deal so the sponsor receives no share of the profits until you get your money back with interest. This motivates the sponsor to prioritize the return of your invested capital as quickly as possible.

Here's Our Investor Friendly Deal Structure

We have structured our deals so that even after your initial investment has been returned to you, you will remain in the deal and continue to earn income and build wealth indefinitely.

Here's how that works.

1. First, you will receive an 8% preferred return. That is like a yield on a stock or interest.

2. Then you get back your initial invested capital. At this point you have zero money at risk. This is the Holy Grail moment.

3. Only now does the sponsor get his first compensation in the form of a catch up.

4. You then receive a pro-rata share of 70% of all profits going forward until you have doubled your initial investment. Keep in mind that at this point you will have no risk as you will have no capital left in the deal.

5. Once your initial investment has been doubled, you will continue to receive your pro rata share of 50% of all profits until the farm is sold.

Alignment of Interest

This structure ensures an alignment of interest with the General Partner for two reasons. The general partner is investing 10% of the equity alongside with and in the same form as you. But he does not share in any of the profit until all your money has been returned, with interest.

Also, the deal is structured to motivate the general partner to at least double your investment without being driven to sell the property to do that. That is particularly important as we head into uncertain economic times; it is designed specifically to ride the storm and build wealth long term for everyone.

Space is limited and we expect each acquisition to oversubscribe quickly.

How a $100,000 Investment is Projected to Look

This is how a $100,000 investment is projected to look in a typical deal, assuming a sale in year ten. Our intent is to hold our ranches for a longer period, but for demonstration purposes, these are indicative 10-year hold projections. Please note that these numbers below are not based on projections from a specific deal but are for illustrative purposes only. Please check the projections for any specific deal you are considering.

Projected returns for $100,000

Return of Capital: $100,000

Total + return of capital + preferred returns + profit split: $257,413

Total equity multiple: 2.57x

Ongoing returns if no sale in year 10

Equity remaining in the deal: $0

Share of profits year 11: $18,643

The total projected preferred returns plus profit split is $257,413 which, including return of your $100,000 capital is a total projected equity multiple of 2.57x.

Even after you have received all your capital back plus interest in the form of the preferred returns, you will continue to get ongoing returns even though you will have no risk capital left in the deal.

Investors will continue to get dividends even after their capital has been returned. An early projection for one of the deals currently in negotiation is that someone investing $100,000 will receive $18,643 in year 11 - this even after all the original invested capital has been returned.

That's better than an 18% return on the original investment with no money in the deal, yet dividends will continue indefinitely until a ranch is sold.

This is what makes investing with BFC in these deals so different from anything you’ve seen before.

Space is Limited

The minimum investment for our deals is $25,000 which means that there will always be a small maximum of possible investors in any given deal. For example, our first transaction has only room for 144 investors and as the General Partner is co-investing 10% of the equity, that leaves fewer than 130 possible investors.

The average investment in these kinds of real estate syndications is usually between $50,000 and $100,000, which means that there are likely to be only 65 investors in this deal, possibly as few as only half of that, or 32 or 33 investors - and this is a likely scenario for all our acquisitions.

Consequently, our deals tend to oversubscribe very quickly.

So, if you want to:

- Hedge inflation by investing

- Invest in one of those rare real estate opportunities where you continue getting paid even after your original investment has been returned

- Ride out the coming economic downturn with a long-term, risk mitigated, high return real estate investment.

- Receive long term income while building your wealth where you have zero risk once your capital is returned.

If you want all that then…

How to Get Access to Our Next Opportunity

Join the waitlist to qualify for the first deal by clicking the link below.

<< JOIN THE WAITLIST>>

We qualify all investors for our deals because we need to keep information confidential. We know the farms we acquire very well. To the extent possible we like to buy them off market at favorable prices and not create noise in the industry that could derail our processes.

Part of the waitlist qualification process is going to be that you agree to keeping deal information confidential.

Once you have successfully joined the waitlist, you will get further details about the specifics of the next farm we are buying and the full set of offering documents for your review and to share with your financial, legal and tax advisors.

And as soon as we are ready to accept investors we will let you know.

Summary

Here’s a recap for you of how you can earn passive income and build wealth investing in farmland with BFC, potentially eliminate all risk by getting your capital back and yet continue to earn income for the long run with no money left in the deal.

- BFC focuses on The Oasis of California's Central Valley

- We buy small underutilized farms from legacy owners

- We add value to optimize revenue, sustainability and profitability

- We bring economies of scale through packing and shipping in-house.

- We consolidate farms into large institutional scale operations to provide high value exit options.

- We benefit from changes in the farming industry: institutionalization of the industry and a disproportionate rise in the value of our ranches; changes in the farmland pricing structure from per acre to yield based underwriting; and elimination of vast tracts of farmland in the Central Valley because of water supply issues - - increasing the value of our ranches and demand for our products.

The six pillars to our success are:

- A historical disconnect between farmland pricing and its true value as income producing real estate

- Consolidation of a highly fragmented industry to make it attractive to institutional buyers.

- Our value-add strategy.

- The BFC packing and shipping competitive advantage.

- Outsized tax benefits unique to farmland.

- Leveraging the upside of supply contraction due to drought.

<< JOIN THE WAITLIST >>

* This article does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Bravante Farm Capital (BFC) or any other third party regardless of whether such security, product or service is referenced. Furthermore, nothing in this paper is intended to provide tax, legal, or investment advice and nothing in this paper should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. BFC does not represent that the securities, products, or services discussed in this paper are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.